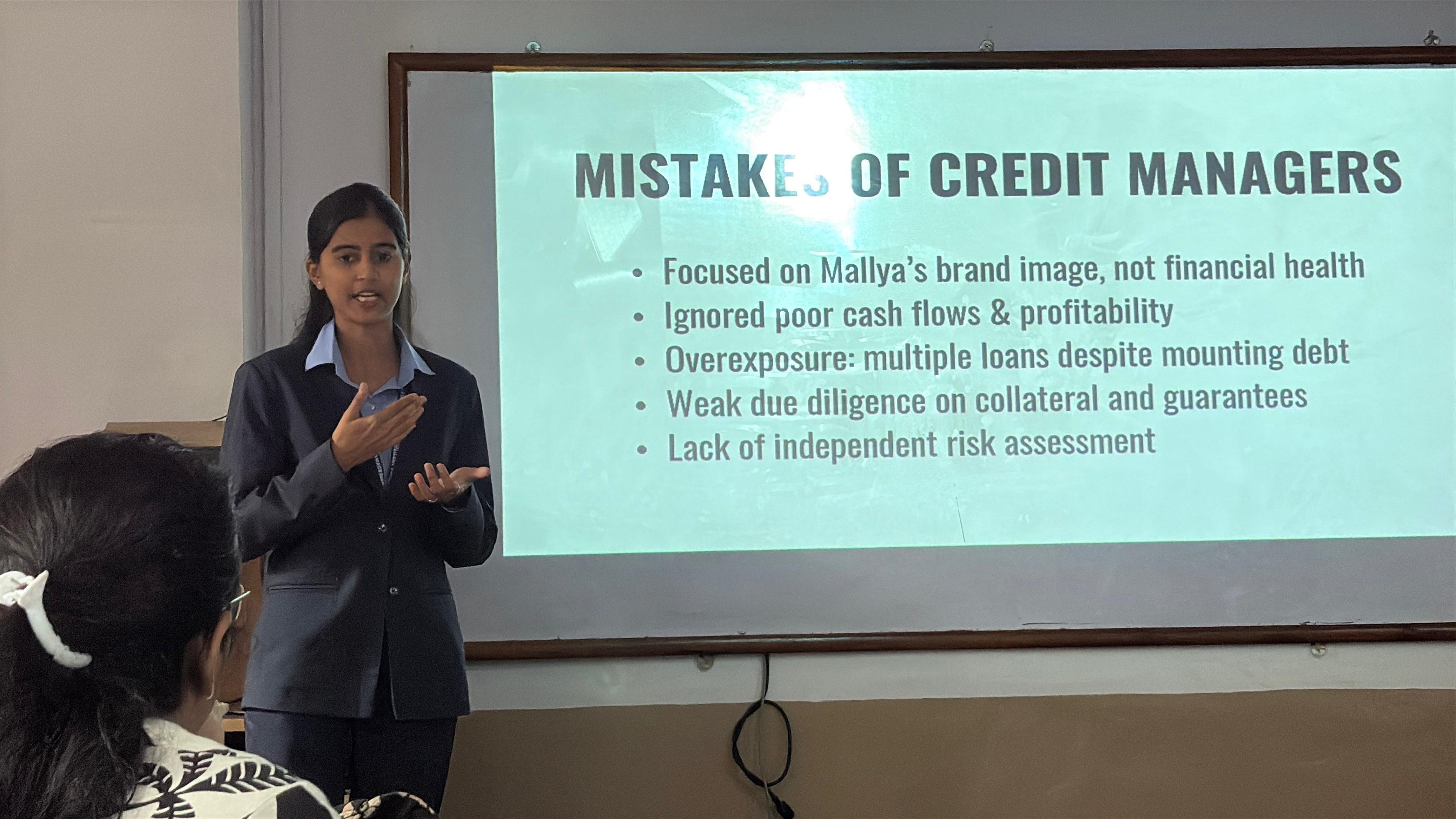

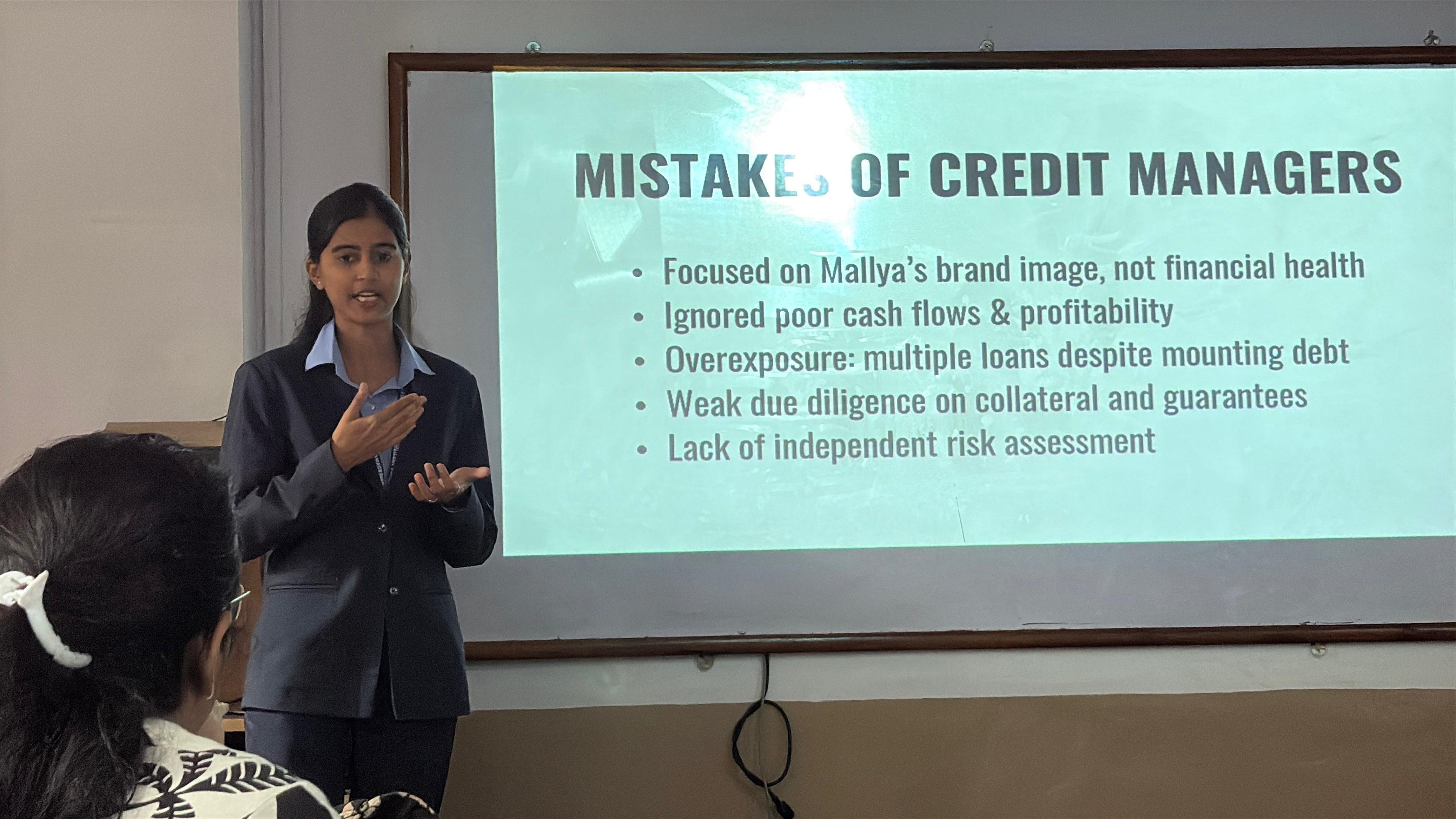

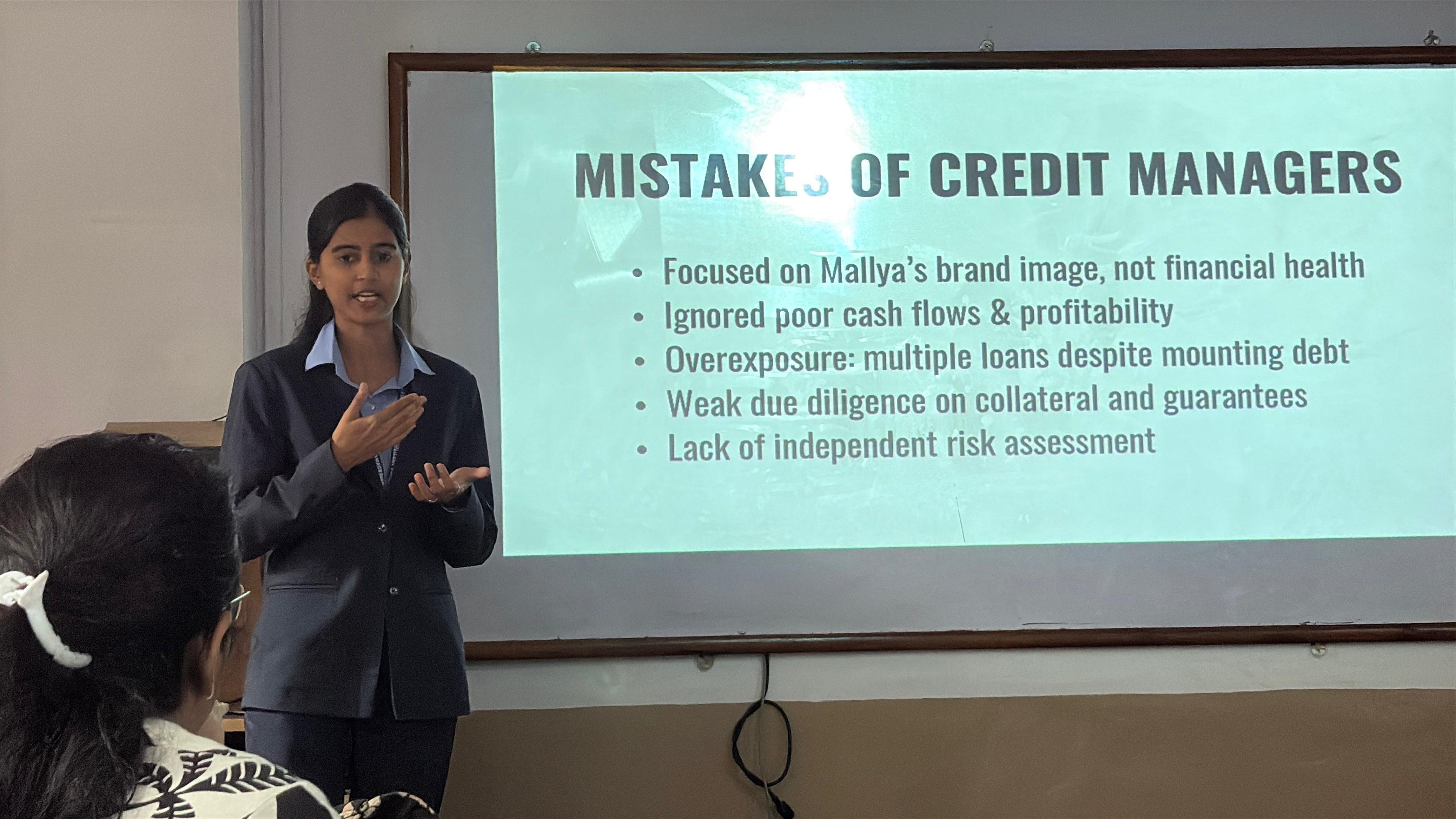

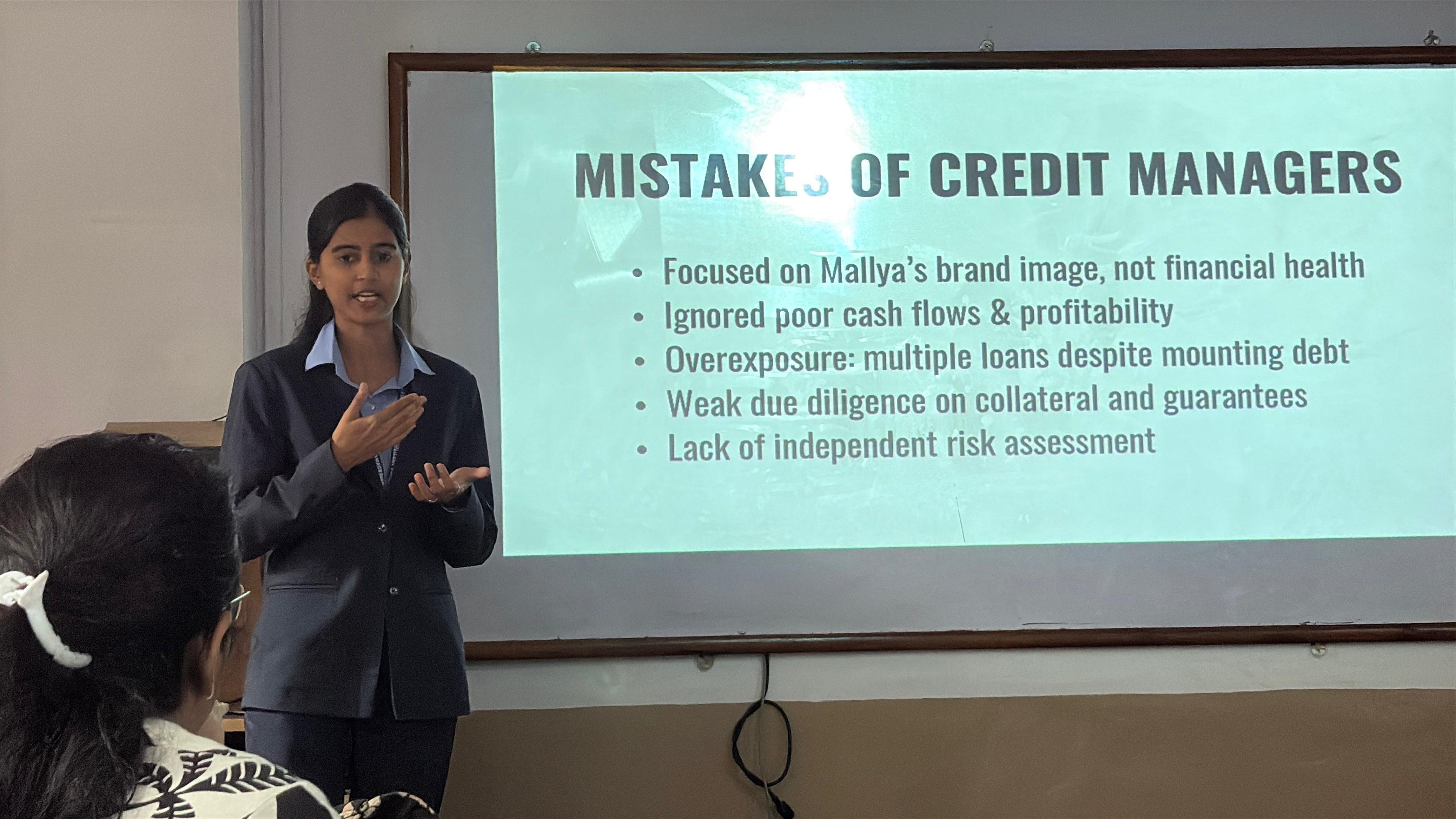

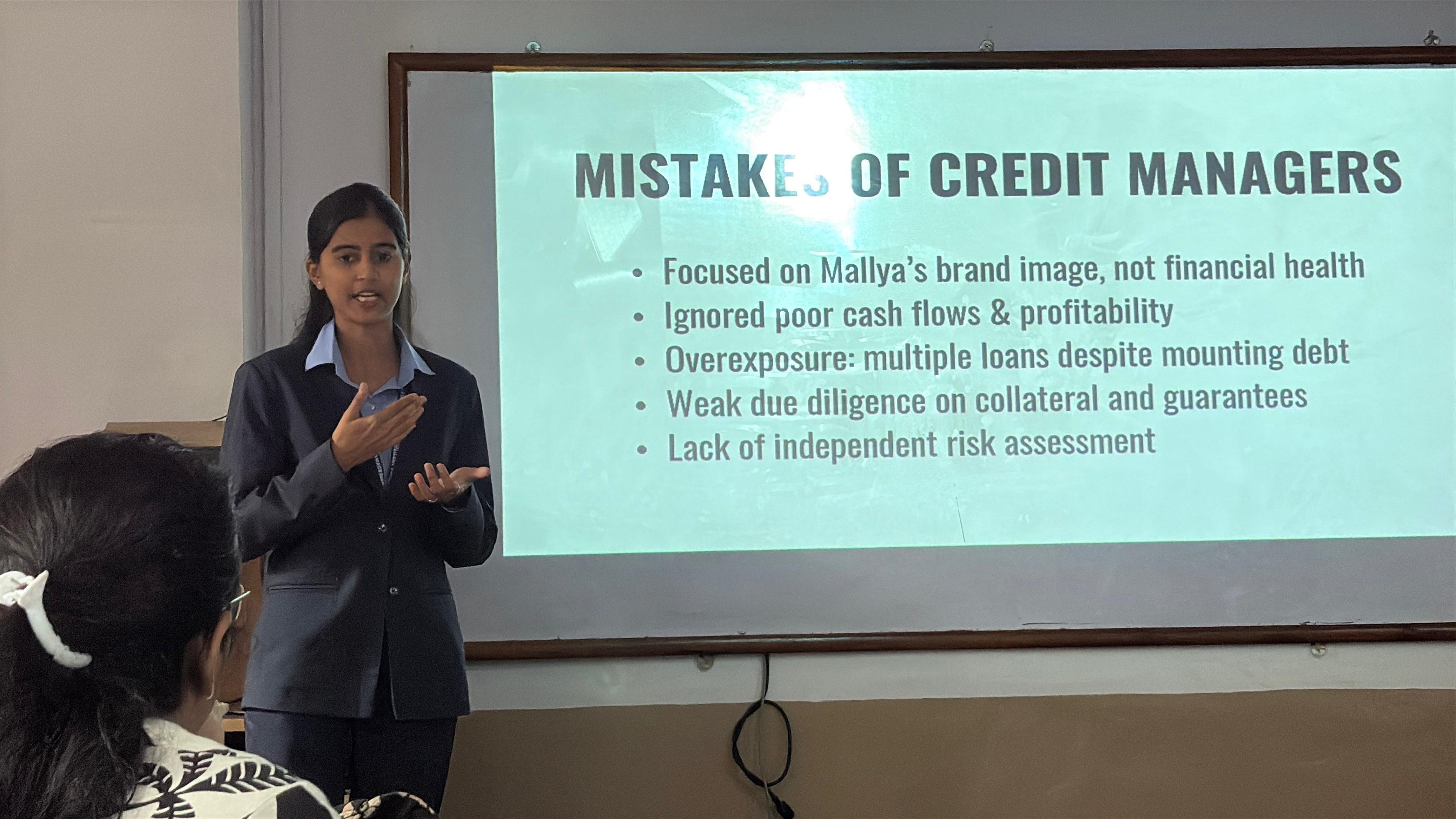

Training Photos

At Finyatri, we’re redefining how corporate finance training should be — practical, relevant, and laser-focused on industry-readiness.

Our corporate training programs are specially crafted for MBA students and ambitious professionals looking to thrive in high-impact finance roles across industries. Designed by seasoned finance professionals and led by Preksha Deokar, a qualified expert and passionate educator, our training blends academic knowledge with real-world skills that companies actually look for.

We go beyond theory — our sessions are hands-on and immersive. Think:

If you're ready to dive into the world of finance and unlock your inner finance ninja, then Finyatri Corporate Training Solutions is exactly where you need to be. Join us — and let’s make finance not just rewarding and career-defining, but also exciting, practical, and a whole lot of fun!

Empower your finance journey with our specialized courses, led by industry experts, to help you grow in the fast-paced world of finance – your ticket to conquering a core finance role. Get certified with industry-recognized credentials that add real value to your career